- THE GLOBAL HUSTLR

- Posts

- 📩 The Fed cuts again as Wall Street rotates into a new phase

📩 The Fed cuts again as Wall Street rotates into a new phase

👋 Hey Hustlrs,

Hope you’re winning both at work and with your money this week.

Markets just gave you a real-time masterclass in rotation: tech and AI finally took a breather, while small caps and old-school cyclicals stepped into the spotlight after another Fed rate cut.

In this edition, you’ll get a simple, fun, and actionable breakdown of what moved markets, why the mood shifted, and how you—as an African investor—can position for this new phase without overreacting.

☕️ Quick Brew: This Week’s Market Pulse

📉 Tech and AI hit a speed bump – The Nasdaq had its worst day in three weeks as chip and AI names sold off sharply on Friday.

🔄 Rotation into value and small caps – The Dow and Russell 2000 outperformed as investors moved money into industrials, financials, and smaller US companies.

✂️ Fed delivers another rate cut – The Fed cut rates for a third straight meeting and signaled a soft-landing is still the goal, but hinted cuts may slow from here.

🧊 Growth cools, but doesn’t crack – Labor and inflation data stayed in “soft, not broken” territory, supporting the idea of slower but still positive growth.

🛢 Oil sinks, gold stays strong – Crude hovered near four-year lows on oversupply worries, while gold held near record levels as a hedge against uncertainty.

🪙 Bitcoin wobbles with risk assets – Crypto weakened again as the tech selloff and risk-off mood spilled into digital assets.

🔑 The Big Stories

1️⃣ Choppy Week, Mixed Finish

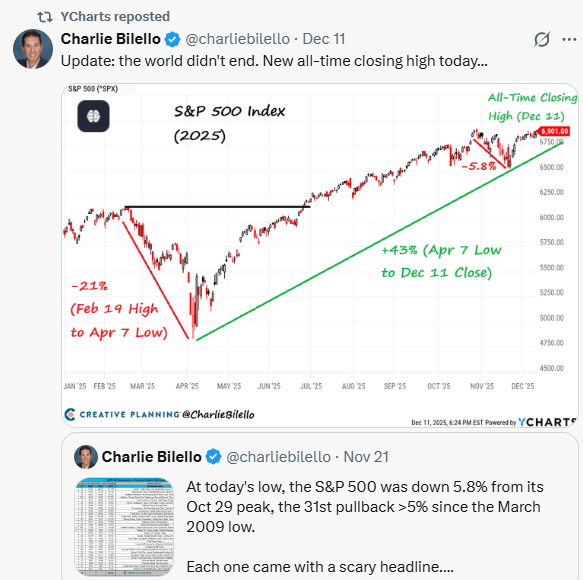

US stocks swung between fresh highs and a sharp late-week selloff, finishing the week with mixed returns.

The Dow ended up around +1.0%, supported by industrials and value names, while the S&P 500 slipped roughly −0.6% after touching a record earlier in the week.

The Nasdaq dropped about −1.6% as traders took profits in crowded tech and AI trades, even though the broader macro story did not break.

📌 Why it matters: You’re seeing a rotation, not a crash—money is moving within the market instead of leaving it; that means you should think about balance, not panic exits.

2️⃣ Tech Cools, Small Caps Heat Up

Under the surface, the big story was a shift in leadership.

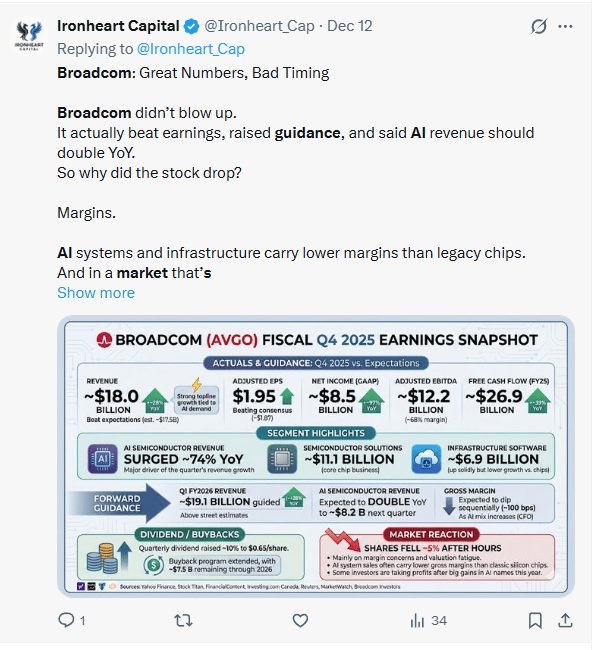

AI and chip names took a hit after Broadcom’s huge one-day market cap wipe-out and cautious guidance made investors question how fast AI revenues will ramp.

At the same time, the Russell 2000 small-cap index hit new highs during the week before giving back some of those gains, supported by optimism around a soft landing and lower borrowing costs.

📌 Why it matters: This is your cue to diversify beyond mega-cap tech—the market is rewarding smaller, more economically sensitive names too, especially if you’re investing with a long-term lens.

3️⃣ Fed Cut #3 and the Soft-Landing Playbook

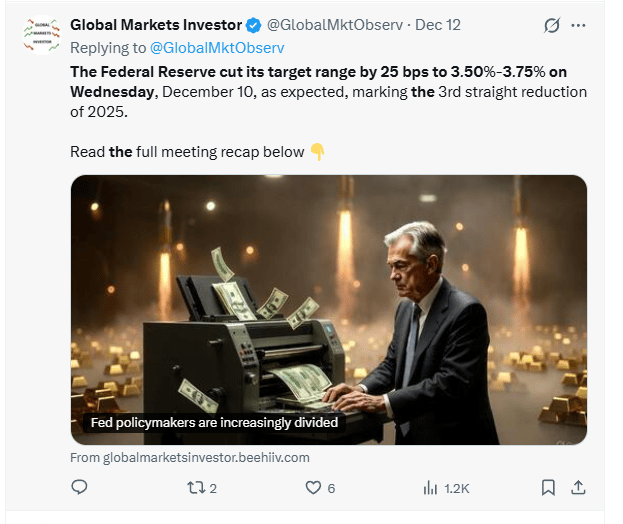

The Federal Reserve cut its target range by 25 bps to 3.50%-3.75% on Wednesday, December 10, as expected, marking the 3rd straight reduction of 2025.

Officials said the move reflects softer labor data and easing inflation, but they also pointed to tariff risks and incomplete data as reasons to stay cautious about how far cuts can go.

Markets read this as confirmation that the Fed still aims for a soft landing—slower growth, but no deep recession—while also signaling that the cutting cycle could be closer to its later innings.

📌 Why it matters: Lower rates support stocks, small caps, and risk assets, but they can also increase volatility as traders debate when cuts stop; you benefit most by staying invested and not trying to trade every Fed headline.

4️⃣ Macro: Soft Labor, Slow Disinflation

Economic data stayed in the “not too hot, not too cold” zone.

Job-openings and labor indicators showed companies pulling back slightly on hiring without triggering a spike in unemployment fears.

Inflation nowcasts pointed to slow disinflation, backing the Fed’s narrative that price pressures are easing, but not collapsing into outright deflation.

📌 Why it matters: This combo—cooling jobs + easing inflation + rate cuts—is one of the most supportive setups for equities, especially for cyclical and small-cap names that thrive when the economy slows, but doesn’t break.

5️⃣ Beyond Stocks: Oil, Gold, Yields, and Bitcoin

Oil, gold, and crypto told their own stories this week.

Crude traded near four-year lows as oversupply and demand concerns offset geopolitical worries, keeping fuel prices in check and easing inflation fears.

Gold hovered near record highs, supported by lower rates and ongoing macro uncertainty, while Treasury yields ticked higher and bonds posted small losses as traders looked ahead to fewer cuts in 2026.

Bitcoin stayed volatile and drifted lower into the week’s end as the broader risk-off tone in tech and growth spilled into crypto.

📌 Why it matters: You’re getting a rare combo—low oil helps tame inflation, gold offers protection, and yields remind you to keep some safe, income-producing assets alongside equities and any speculative crypto.

💡 What Does This Mean for Your Investments?

Rate cuts favor growth, but rotation is real. Lower rates still help growth and tech, but the market is clearly rewarding small caps and cyclicals as well, so you don’t want all your chips on one sector.

AI is a long game, not a straight line. Broadcom’s selloff shows that even strong themes can overshoot and correct; this is a reminder to use diversified ETFs for AI exposure instead of relying on a few “story stocks.”

The dollar path matters for you. A cutting Fed usually means less upward pressure on the US dollar over time; that’s good for global markets, but it may slightly reduce the FX boost you get from holding USD assets from Nigeria, Kenya, Ghana, or South Africa.

Oil and gold are quietly helping your risk management. Cheaper oil helps keep global inflation down, while strong gold prices remind you there is demand for safety—both are useful signals as you shape your asset mix.

Action steps you can apply right now:

Set or increase a monthly automatic investment into broad US equity ETFs (S&P 500, total market, or global funds) so you benefit from this rotation without trying to time it.f

Build or refine a watchlist of quality cyclicals and small-cap ETFs, plus diversified tech/AI funds, and plan to add on weakness instead of chasing rallies.

📣 Final Sip

Weeks like this separate traders from builders. Traders chase the hot story of the moment. Builders like you focus on owning great assets, adding consistently, and letting time and discipline do the heavy lifting.

You don’t need to predict every Fed move or AI headline. You just need a simple plan you can stick with when markets rotate, wobble, or surge.

🚀 Join the Movement

If this breakdown helped you see US markets more clearly from Lagos, Nairobi, Accra, Johannesburg, or the diaspora, share it with one friend who’s ready to start investing globally.

The Global Hustlr exists to help African professionals build real, dollar-denominated wealth through simple, smart investing in the world’s biggest markets—one weekly newsletter at a time.

This newsletter is strictly educational and not investment advice . The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser.

Reply