- THE GLOBAL HUSTLR

- Posts

- 🌍 Small-Cap Stocks Lead the Charge with Strongest Start in Years

🌍 Small-Cap Stocks Lead the Charge with Strongest Start in Years

Hello Hustlrs,

Hope the first full work week of 2026 treated you well.

Wall Street came out flying: US stocks hit fresh record highs, small caps woke up, and hard assets stayed strong.

This issue keeps it fun, simple, and actionable so you can turn global market noise into a clear plan from Lagos, Accra, Nairobi, Joburg or wherever you hustle.

Let's dive in and get you ready to build that global wealth!

☕️ Quick Brew: This Week’s Market Pulse

US markets kicked off 2026 with a bang as major indices hit records, the jobs report came in soft-but-okay, and money rotated into small caps, materials, and hard assets.

📈 Dow & S&P 500 closed at new record highs to wrap a strong first week of 2026

📊 Nasdaq surged as tech joined the rally, but leadership broadened beyond just the mega-caps.

🧾 US jobs report showed only ~50k new jobs, but unemployment dipped to 4.4%, signalling a cooling yet still resilient labour market.

🔄 Big rotation into materials and small caps – materials jumped over 4% and the Russell 2000 gained around 4–5% for the week.

🥇 Gold and silver stayed firm, while investors also piled into cyclicals and industrials on global growth hopes.

₿ Bitcoin held near the mid-90k zone, trading more like a high-beta risk asset as traders watched 90–92k support and 95–100k resistance

🔑 The Big Stories

1. New Highs – Records to Start 2026

The Dow and S&P 500 ended the week at record closing highs, with all three major US indices logging solid gains as investors shrugged off last week’s wobble.

A cooler but not collapsing jobs report (about 50k new jobs added and unemployment down to 4.4%) reinforced the idea that the US may be sliding into a “soft landing” rather than a deep recession.

Lower long-term yields and steady earnings expectations helped keep risk appetite strong, especially for quality US names.ajg+3

📌 Why it matters:

Record highs scare many African investors into waiting for a “big dip,” but history shows markets often grind higher for years; staying invested in broad US exposure usually beats trying to time the exact top.

2. Rotation – Small Caps & Materials Rip Higher

This week wasn’t just another mega-cap story.

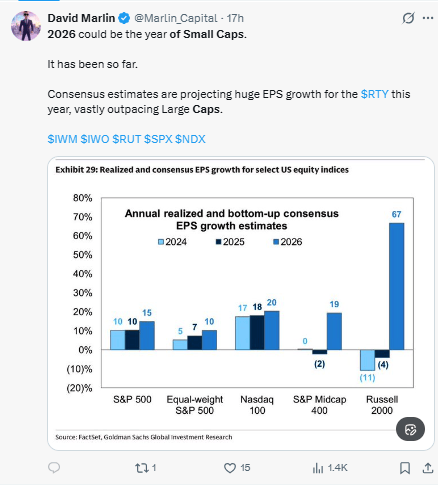

The Russell 2000 small-cap index jumped roughly 4–5% as money moved into more cyclical areas of the market, including materials, industrials, energy, and consumer staples.

Materials led the S&P 500 sectors with gains above 4%, signalling that investors are betting on real-world growth, infrastructure, and commodity demand – not just software and AI headlines.

📌 Why it matters:

A broader rally means more of your ETF holdings can participate, not just the Magnificent 7; adding or maintaining some small-cap and cyclical exposure can help you capture more of the upside when the market widens out.seekingalpha+2

3. Policy Watch – Tariffs, Mortgages, and Macro Risk

In the background, markets tracked two big policy stories.

First, investors watched for the Supreme Court’s ruling on President Trump’s sweeping tariff package, which could reshape global trade flows, corporate costs, and inflation if upheld.

Second, Trump directed Fannie Mae and Freddie Mac to buy up to $200 billion of mortgage-backed securities in 2026 to push mortgage rates lower and support the US housing market.

📌 Why it matters:

For African investors, tariffs and mortgage policies may sound distant, but they influence the strength of the US consumer, global trade, and the dollar – all of which affect your portfolio and local currency over time.

4. Hard Assets – Gold Holds, Bitcoin Acts Risky

Bitcoin pushed above 94k early in the week and is hovering near cycle highs, behaving like a high-beta risk asset that surges when risk appetite is strong and drops quickly when sentiment flips.

Gold and silver, on the other hand, remain firm as classic hedges, supported by lingering worries over tariffs, policy mistakes, and long-term inflation, even while stocks hit fresh records.

📌 Why it matters:

This split is a clear reminder: gold (and to a degree silver) belongs in your protection bucket, while Bitcoin fits in your speculation bucket; mixing the two up can lead to nasty surprises when volatility hits.

💡 What Does This Mean for Your Investments?

1. The Rally Is Broadening – Don’t Just Own One Story

US stocks at record highs, plus strong moves in small caps and materials, show that more parts of the market are now contributing, not only AI mega-caps.

2. Soft-Landing Odds Still Look Reasonable

Slower job growth but lower unemployment fits a “cooling but not crashing” US economy, which normally supports steady gains for quality stocks over time.

3. Cyclicals and Hard Assets Deserve a Slice

With materials, industrials, and metals all in favour, portfolios made only of tech and cash risk missing an important leg of the 2026 story

4. Policy Can Change the Map Quickly

Tariff rulings, mortgage support, and Fed decisions will drive the path of the dollar, inflation, and global trade – key variables for African professionals who earn in local currency but invest in dollars.

🚀 Action Step:

👉 Use this as your “what to do this week” checklist:

Over the next few weeks, aim to:

✅ Check your core allocation – if you’re still underweight broad US ETFs, start or increase a regular monthly contribution.

✅ Add or top-up a small-cap ETF – give your portfolio a slice of the Russell-style upside now that small caps are showing strength.wsj+1

✅ Rebalance AI/tech exposure – if mega-caps now dominate your portfolio, trim back to your target weight rather than letting one theme control your future.

✅ Separate hedge from hype – keep gold/silver as your main hedge, and cap any Bitcoin or alt-coin exposure to a small, clearly defined risk bucket. corporate.

📣 Final Sip

Record highs are not a signal to freeze; they’re proof that markets reward people who stayed the course when everyone else panicked.

Investing is a long game.

Play it like a builder, not a gambler.

🚀 Join the Movement

If this breakdown helped you see the US markets more clearly from Lagos, Nairobi, Accra, or Johannesburg, share it with a friend who’s ready to level up their global investing game.

The Global Hustlr is on a mission to help African professionals build real, dollar-denominated wealth through smart, simple investing in the world’s biggest markets—one weekly newsletter at a time.

Subscribe today and take control of your investment journey across borders.

Stay smart, stay global, stay Hustling.

The Global Hustlr Team!

This newsletter is strictly educational and not investment advice. The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser.

Reply