- THE GLOBAL HUSTLR

- Posts

- Rate Cut Signals and Trade Tensions

Rate Cut Signals and Trade Tensions

👋 Hey Hustlrs,

What a week!

Wall Street gave us a front-row seat to some serious drama — from inflation jitters to tariff battles and whispers of an imminent Fed rate cut.

Think of it as a movie where central banks, China, and investors all took turns rewriting the script. But as always, your mission remains the same: stay informed, stay patient, and turn global market noise into opportunity.

This week’s round-up simplifies everything that shaped the global stage — and what smart African investors like you should watch next.

Let’s brew it down.

☕️ Quick Brew: This Week’s Market Pulse

📉 Stock slip: U.S. equities ended lower after a volatile week, with the S&P 500 dropping 1.13% and the Nasdaq 100 down 1.19%.

💰 Gold continues to shine: Up above $4,200 per ounce, now up over 65% year-to-date as investors flee into safe havens.

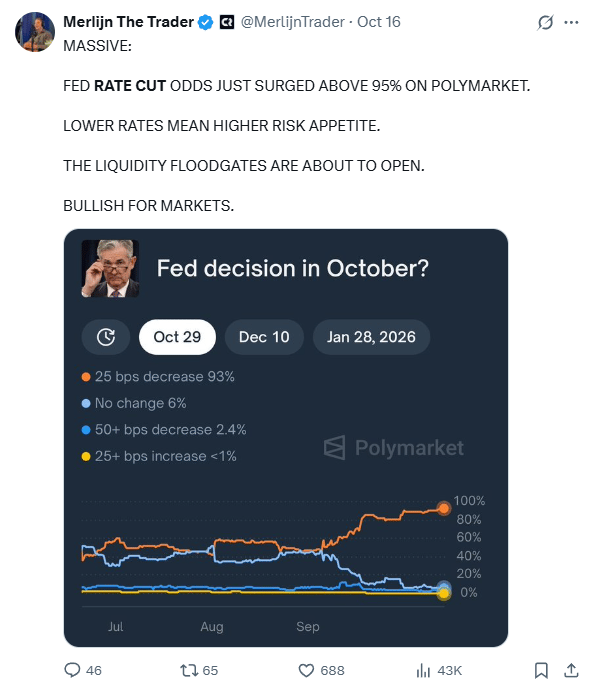

🏦 Fed talk: Policymakers hint at a late-October rate cut to support growth amid mixed economic data.

🇨🇳 Tariff tango: The U.S. slapped 100% tariffs on Chinese imports, only to agree to new trade talks days later.

🏛 Government freeze: The U.S. government shutdown dragged into another week, delaying key economic data.

🪙 Bitcoin blues: Crypto slid over 5%, with traders rotating out of riskier assets as global credit risks reemerged.

🔑 The Big Stories

The Great October Balancing Act

Here is the weekly performance summary of major U.S. indices and key assets week ending October 17, 2025:

Despite a strong rebound on Monday (S&P 500 up 1.6%, Nasdaq +2.2%), U.S. equities finished the week in negative territory:

S&P 500: down 1.13%

Nasdaq 100: down 1.19%

Dow Jones Industrial Average: down 0.44%

Russell 2000: down 0.95%

Financials underperformed despite solid Q3 bank earnings, while utilities, healthcare, and transportation stocks showed resilience

Trade Tensions and Tariff Whiplash

President Trump set markets on fire early in the week with a bold 100% tariff on Chinese imports — from tech components to Boeing parts.

China fired back with rare-earth restrictions, intensifying supply chain worries. Then, a Friday pivot: officials from both nations announced new trade talks for the following week, cooling the flames.

📌 Why it matters: For global investors, this is more than headlines. African exporters tied to U.S.-China trade channels (especially in minerals and manufacturing) could face ripple effects on prices and demand.

Volatility here means both challenges — and short-term trading chances in gold and commodities.

Fed Softens Its Stance

Federal Reserve officials, including Governor Christopher Waller, signaled growing support for a late-October rate cut, trimming the target range from 4.25% to potentially 3.75%.

Policymakers admitted they’re walking a thin line: inflation remains sticky (headline 2.9%) but the labor market is cooling. Meanwhile, the government shutdown is blinding data visibility.

📌 Why it matters: Rate cuts tend to buoy tech, consumer, and emerging market assets — but inflationary stickiness could lead to more volatility. For African investors, falling U.S. rates often strengthen foreign currencies and support portfolio diversification into growth ETFs and high-yield bonds.

Liquidity and Banking Concerns Fade Fast

Midweek saw a mini bank selloff after rumors of credit stress hit smaller U.S. lenders like Zions.

But Moody’s analysts quickly reassured that it was isolated — “no systemic problem.” Banks borrowed $8.35 billion through the Fed’s standing repo facility, a safety net that helped stabilize liquidity by Friday.

📌 Why it matters: Bank stress moments reveal market fragility — but they also show how fast central banks step in to plug gaps. African investors eyeing U.S. financial ETFs or dividend-heavy stocks should view dips as potential entry windows.

Safe Havens Dominate

Gold continued its breakout streak, up above $4,200 per ounce, as central banks reduced exposure to Western currencies and investors sought protection from geopolitics and U.S. fiscal worries.

At the same time, Bitcoin fell 5.1%, as easing global tensions cooled the demand for speculative hedges.

📌 Why it matters: This “gold vs. Bitcoin” split signals how institutions are hedging. Gold remains the favored insurance policy, while risk-off sentiment makes crypto assets swingier. African investors diversifying internationally should consider gold ETFs or physical holdings to balance growth exposure.

The Shutdown Saga Continues

The U.S. government shutdown stretched into another week.

Core data like inflation and jobs reports were delayed — frustrating both markets and the Fed.

The fiscal standoff added uncertainty to spending plans and signaled deeper political gridlock.

📌 Why it matters: The longer Washington drags this out, the likelier it is that consumer sentiment and business investment get hit — slowing U.S. growth. For global investors, political dysfunction in the world’s biggest economy often translates into stronger gold prices, weaker U.S. yields, and currency volatility across emerging markets.

💡 What Does This Mean for Your Investments?

Rate cuts on the horizon boost tech and growth assets but can reignite inflation fears — diversification remains key.

Tariff and trade volatility might shake short-term sentiment, yet defensive sectors (utilities, healthcare, transport) show relative strength.

Currency shifts from Fed easing could favor emerging markets — including African equities and dollar-based ETFs.

Gold’s momentum reinforces it as a hedge against global policy noise; Bitcoin remains a high-beta, optional play.

Action steps:

Rebalance portfolios to ensure exposure to core U.S. indices and gold-related assets.

Avoid over-concentration in rate-sensitive financials until clarity improves post-Fed meeting.

Track renewed U.S.-China negotiations — any resolution could trigger a mini global rally.

📣 Final Sip

The markets this week reminded us that even chaos has cycles. Every sharp swing — like every tariff, spike, or dip — is really just part of a rhythm investors can learn to dance to.

Think like a marathon runner, not a sprinter: pace yourself, stay diversified, and keep stacking assets that work for you.

Your wealth journey isn’t about timing every headline. It’s about mastering your mindset when the noise gets loud.

🚀 Join the Movement

The Global Hustlr isn’t just a newsletter — it’s a mission to help African professionals build real global wealth, one smart decision at a time. 🚀

If this edition gave you fresh insight and confidence, share it with your fellow African professionals looking to grow their wealth globally. At The Global Hustlr, we’re on a mission to empower you with clear, actionable investing updates so you can own your financial future — no matter where you are in the world.

Stay smart. Stay global. Stay hustling.

This newsletter is strictly educational and not investment advice. The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser

Reply