- THE GLOBAL HUSTLR

- Posts

- Markets stumble. Is this the start of a strong market rebound or a deeper selloff

Markets stumble. Is this the start of a strong market rebound or a deeper selloff

👋 Good morning,

This is The Global Hustlr, your passport to Global Wealth — we cut through the noise, in plain talk, no fluff, simplify Global Markets to help you invest and build lasting wealth.

Here’s what we got for you today:

☕️ Quick Brew: This Week’s Market Pulse

📉 Tech and AI stocks lose their shine

🏥 Defensive sectors quietly lead

🏦 Fed signals keep markets guessing on rate cuts

📊 First post-shutdown data shows a cooling, not collapsing, economy

💻 Nvidia earnings hype meets AI anxiety

💰 Gold rebounds while Bitcoin slides toward $90K

🔑 The Big Stories

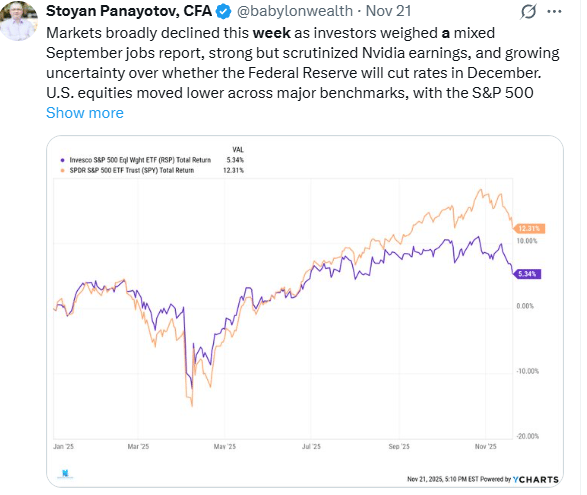

US stocks had a rough week, with big tech and AI names under pressure while safer parts of the market quietly held up.

Major US stock indices fell sharply for the week, with growth stocks and technology leading the declines amid renewed risk aversion.

Defensive sectors like health care and consumer staples gained, while traditional safe havens such as gold outperformed and Bitcoin dropped toward $90,000.

Shifting Federal Reserve signals—especially mixed remarks over rate cuts—added to market volatility, impacting investor sentiment and US Treasury yields.

The week’s moves signal a clear preference for stability and safety—money flowed from high-expectation tech and speculative crypto into defensive sectors, gold, and cash generators.

📉 Tech and AI stocks lose their shine

High-growth tech, especially AI and chip names, sold off even after strong earnings from Nvidia , as investors started to question whether AI expectations had run too far ahead of reality.

This weighed heavily on the Nasdaq and dragged the whole market lower, showing you that even “hot” themes can face sharp pullbacks when sentiment turns.

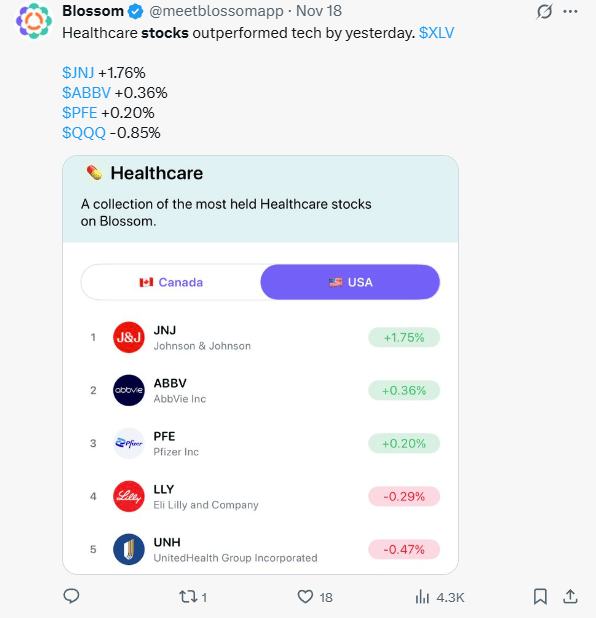

🏥 Defensive sectors quietly lead

Health care and consumer defensive stocks finished the week in positive territory, even as the main indices fell, showing investors hiding in more stable, cash-generating businesses.

If you’re heavily tilted to aggressive tech, this rotation is a signal to check whether you own enough steady, boring names that can balance your portfolio when growth stocks get hit.

🏦 Fed signals keep markets guessing on rate cuts

Federal Reserve officials sent mixed messages: minutes from the last meeting and public comments showed a divided central bank, with some pushing to hold rates while others, like New York Fed President John Williams, opened the door to a possible December cut.

Markets swung as the implied odds of a cut dropped sharply during the week and then jumped again after Williams’ remarks, reminding you that shifts in rate expectations can quickly move growth stocks, bank shares, and the dollar.

📊 First post-shutdown data shows a cooling, not collapsing, economy

Key November indicators like flash PMIs and delayed jobs and inflation readings pointed to an economy that is slowing but still growing, with softer labor data and stubborn inflation keeping the Fed cautious.

For long-term investors, this mix usually means more volatility in the short term but not an immediate recession call, so it supports staying invested rather than trying to time every macro headline.

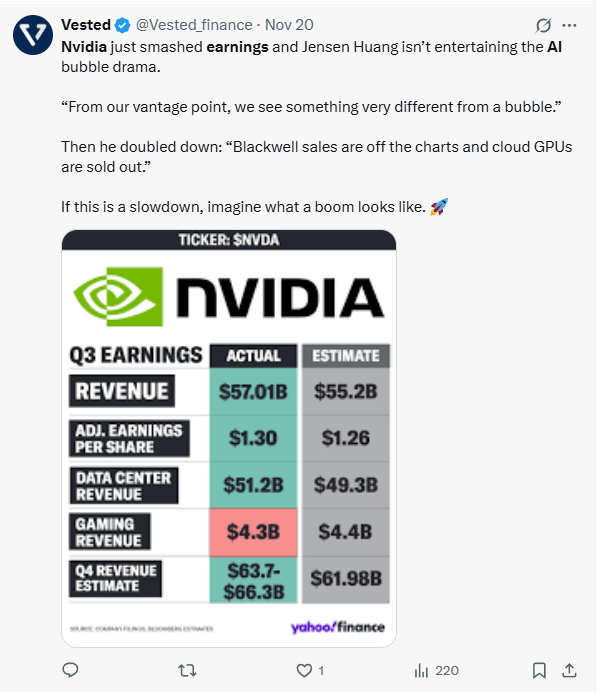

💻 Nvidia earnings hype meets AI anxiety

Nvidia delivered “blowout” quarterly results with huge revenue and profit growth from AI chips, but the stock still fell as traders worried about how long the AI boom can run and whether expectations are now too high.

💰 Gold rebounds while Bitcoin slides toward $90K

Gold rallied as stock volatility picked up and investors looked for safety, while Bitcoin slumped toward the 90,000-dollar area, reflecting a shift away from the most speculative parts of the market.

For you, this split between gold and Bitcoin is a simple fear-versus-speculation signal: money moved toward traditional safety and away from high-octane crypto bets.

Overall, the week had a risk-off tone: growth and tech led the declines, while defensive sectors and gold held up better. Money flowed out of high-expectation areas like AI chips and speculative crypto and leaned more into safety, income, and stability.

Action Steps for Beginners:

If you are dollar-cost averaging into broad US ETFs, a week like this is your friend, not your enemy. Lower prices in the S&P 500 and Nasdaq mean your regular contributions buy more units of high-quality global businesses at a discount.

If you hold a lot of tech and AI winners, this week tells you that sentiment can turn even when earnings are strong. Consider checking your position sizes, trimming any names that dominate your portfolio, and using diversified ETFs or funds to avoid single-stock risk.

If you are deciding between growth and value stocks, the Fed story matters. When rate-cut expectations fade or stay uncertain, expensive growth names usually feel more pain, while steady cash-flow sectors like health care and consumer defensives can offer more stability.

If you invest in small-cap or higher-risk US names, the weakness in the Russell 2000 shows that the market’s risk appetite is still fragile. Treat these holdings as the “spice” in your portfolio, not the main meal—keep the bulk of your money in large, liquid, global businesses.

If you use gold or Bitcoin as part of your strategy, watch how they behave in weeks like this. Gold’s strength and Bitcoin’s drop signal that, in real moments of stress, many investors still prefer traditional safety over speculative assets, so treat crypto as a small, high-risk satellite, not your core wealth plan

📣 Final Sip

The best investors are patient, strategic, and always ready for the next shift.

Remember: wealth is built steadily, not in sudden leaps.

Stay focused, keep informed, and don’t let headlines rattle your long-term vision—especially with delayed data and extra noise in the mix.

🚀 Join the Movement

Know someone who’d love this? Share The Global Hustlr. Subscribe, read weekly, and connect with Africa’s strongest community of global investors. Your journey, our mission—let’s keep growing together!

This newsletter is strictly educational and not investment advice. The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser

Reply