- THE GLOBAL HUSTLR

- Posts

- Is the Market Headed for a Correction? Trade Tensions and Tech Selloff Spark Warning Signs

Is the Market Headed for a Correction? Trade Tensions and Tech Selloff Spark Warning Signs

👋 Hey Hustlrs

It’s a brand-new edition of your go-to global markets newsletter.

This week felt like trading on roller skates—a sudden jolt of trade war drama, rare earths shockwaves, and shutdown worries sent tech stocks tumbling after an early week high.

But don’t worry, as always, you’ll get a simple, fun, and actionable snapshot of what really mattered and how to stay one step ahead in your wealth-building journey.

Let’s break down the stories, the moves, and smart next steps—so you don’t miss the action or lose your cool.

☕️ Quick Brew: This Week’s Market Pulse

📉 US stocks hit reverse as China trade tensions steal the spotlight

💥 Tech and chip stocks sank, especially those exposed to China supply chains

🏦 Government shutdown stretches into day 10, data vacuum frustrates traders

🪙 Gold rallies to $4,000 as investors look for safety

🚀 Bitcoin hums, showing resilience in uncertain times

🇨🇳 China tightens rare earth exports, shaking up global supply chains

⚡️ Trump cancels Xi summit, floats huge tariffs—market reacts instantly

🔑 The Big Stories

This Week in the Markets

Global investors riding the 2025 rally just hit a reality check. Tariff threats, rare earth supply shocks, and China probes into U.S. companies drove a sharp reversal—especially in tech and semiconductors.

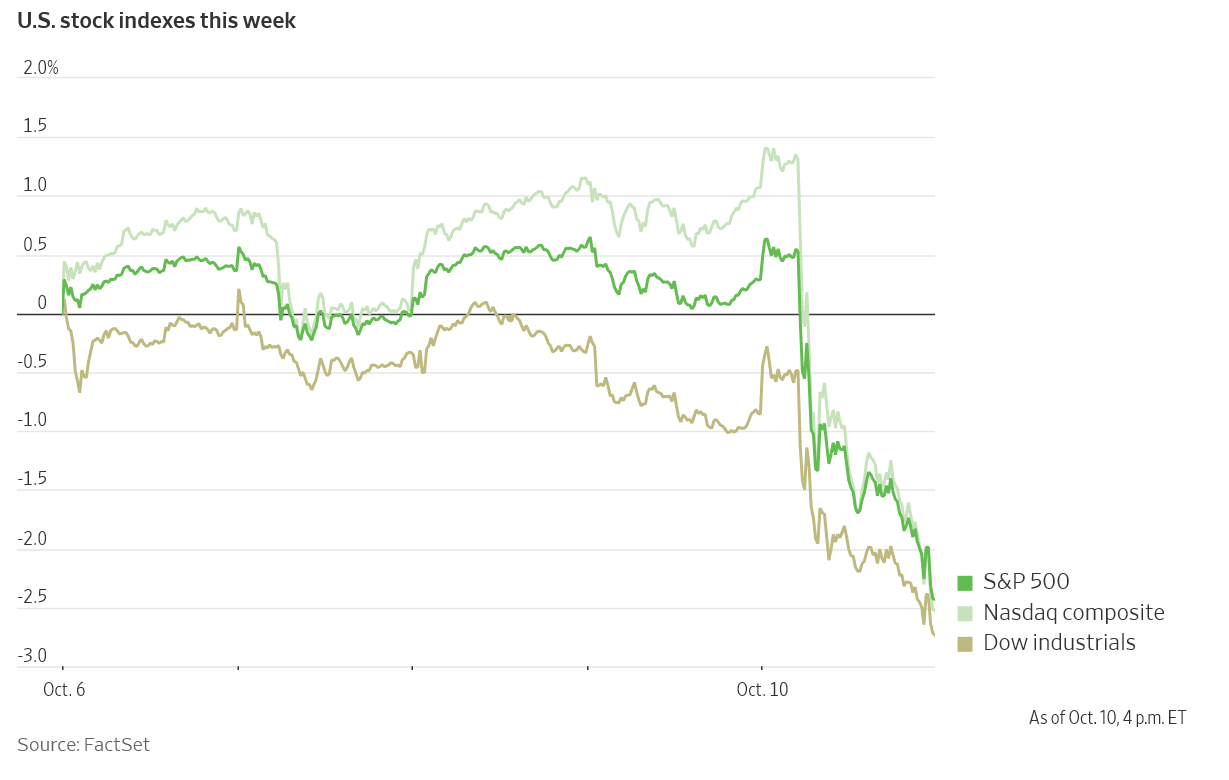

Weekly Performance (Oct 6–10, 2025)

S&P 500: ▼ 2.1%

Nasdaq Composite: ▼ 3.4%

Dow Jones Industrial Average: ▼ 1.8%

Russell 2000: ▼ 1.9%

Gold: ▲ 2.8% to $4,000/oz

Bitcoin: ▲ 1.5% to $63,500

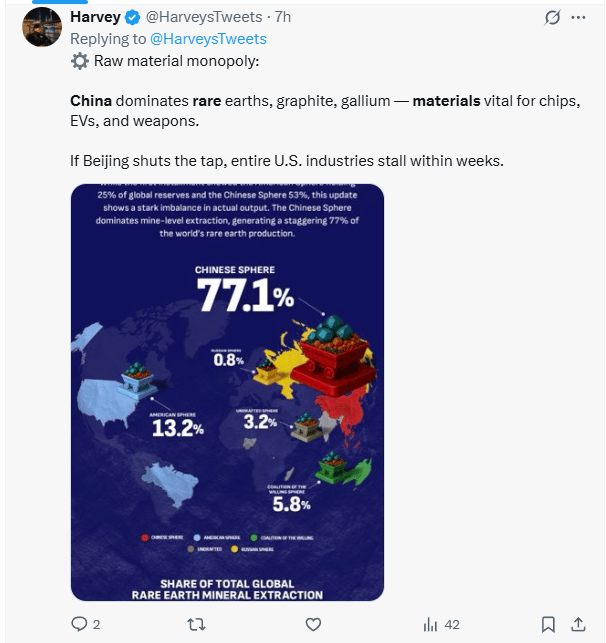

Rare Earth Clampdown

China shocked everyone by slapping new export controls on rare earths, putting strict licensing requirements on anything that contains even a trace of China-sourced materials.

The new rules—set to hit December 1—require full disclosure about buyers and destinations

Why it matters: Almost every tech device, EV, and green gadget uses rare earths, and China controls most global supply.

For global investors, this is a critical supply chain squeeze that could trigger higher costs and volatility across tech, EV, and defense sectors

Trump Tariff Shock

President Trump abruptly canceled his planned face-to-face meeting with Xi Jinping, upping the ante by threatening “massive tariffs”—possibly 100%—on Chinese goods.

He called China’s new export controls holding the world “captive,” and the market didn’t take it lightly.

Why it matters: The US-China trade peace looked possible until Friday’s sudden reversal.

Major downtime in negotiations means jittery markets, less visibility for companies relying on China, and the return of trade war headlines. Investors with international portfolios must watch for rapid shifts in risk sentiment and portfolio allocations.

Tech Stocks Lead Market Reversal

Semiconductor and tech stocks felt the heat—Qualcomm plunged 7.26% on the double whammy of trade threats and a China monopoly probe, while NVIDIA, Broadcom, and Tesla all saw sharp selloffs.

Amazon and Apple, heavy China manufacturers, lost ground too.

Semiconductors were the biggest casualties:

Nvidia: ▼ 3.88%

Broadcom: ▼ 5.2%

Micron: down in sympathy.

Why it matters: Companies with China in their supply or sales chain are facing both regulatory and tariff risk. It’s a wake-up call for portfolio diversification and risk checks—especially if tech is a big slice of your assets.

Government Shutdown Drags On

The US government shutdown rolled into day 10, with no breakthrough. Senate returns Tuesday, but the longest-ever shutdown (34 days) looms as a real possibility.

Delay in jobs data means investors are flying blind, relying on alternative indicators.

Why it matters: Economic uncertainty rises, and market volatility can spike as traders and investors try to read between the lines without fresh official data.

Shutdowns also ripple through sectors that rely on government spending or regulatory certainty

Gold Shines, Bitcoin Steady

As traders sought shelter, gold sped toward $4,000 and silver inched near record highs.

Bitcoin shrugged off the chaos and logged a modest weekly gain.

Why it matters: Defensive assets were back in the spotlight, reflecting investor anxiety.

These moves underline the need for balance between growth and safety—especially for newer investors in choppy global markets.

💡 What Does This Mean for Your Investments?

Markets sold off sharply this week after President Trump announced potential 100% tariffs on Chinese goods.

While the headlines sparked panic, this isn’t a crash — it’s a reset.

The broader market trend remains strong, with major indexes still up double digits this year.

Pullbacks like this are normal and offer disciplined investors a chance to add to quality companies at better prices.

Instead of reacting to fear, focus on managing risk and sticking to your well-thought-out plan.

How to Handle Market Drops: A Hustler’s Playbook

Three-Step Action Checklist

1. Protect Your Portfolio

Shift toward safer strategies—consider options with lower risk or increase holdings in defensive assets.

2. Wait for Confirmation

Don’t rush to buy on dips. Look for price support and strength signals near key moving averages like the 20 or 50-day EMA.

3. Invest in What You Trust

Use pullbacks to add to core holdings with solid earnings and growth that you would hold through volatility.

The best advantage comes from preparation and patience, not reacting to every headline.

This reset is an opportunity to position smarter, not panic faster.

Investing is a marathon, not a sprint.

When the news cycle accelerates and market swings increase, remember: strong portfolios are built on knowledge, patience, and well-timed actions.

Stay curious, stay steady, and keep your eyes on the long-term goal—wealth that grows across continents and market cycles.

🚀 Join the Movement

The Global Hustlr newsletter exists for African professionals who want more than local returns—you want global wealth, opportunity, and confidence.

Forward this round-up to a friend, share your favorite insight, and join us for next week’s market mission.

Subscribe and grow with a supportive community that’s committed to helping Africans become smarter, bolder, and richer global investors.

See you next week, Hustlrs!

This newsletter is strictly educational and not investment advice. The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser

Reply