- THE GLOBAL HUSTLR

- Posts

- How far will Stocks fall?

How far will Stocks fall?

Hey Hustlrs! 🚀

Welcome to The Global Hustlr, your weekly guide to Wall Street’s biggest stories, simplified for driven African professionals.

Each issue breaks down the latest market moves into practical tips you can use to grow your wealth—no matter where you call home.

Let’s dive into this week’s market updates.

☕️ Quick Brew: This Week’s Market Pulse

What a week on Wall Street.

US stocks dropped hard, hit by weak job numbers, trouble in the White House, and President Trump's new wave of tariffs about to strike dozens of countries, including major trade partners.

Through all the chaos, though, the world's top tech giants posted strong earnings.

Their performance reminds global investors why it pays to stay calm, focus on the big picture, and avoid panic when the market gets rough.

The Big Stories

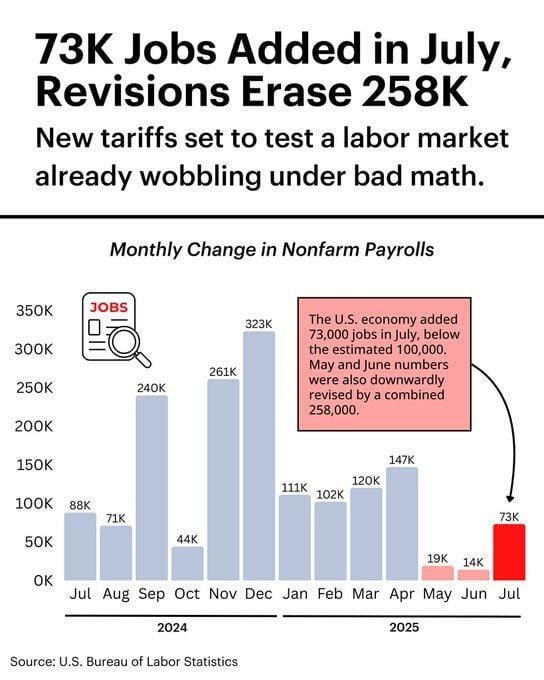

1. Markets Climb a Wall of Worry, But Stumble on Jobs Data

After months of rallying, US stocks took a sharp dive this week.

For the trading week all three major indices were lower

Dow industrial average -2.92%

S&P index -2.36%

NASDAQ index -2.17%

The cause:

August 1 tariffs went into effect

Jobs data came in much lower, with revisions the big contributor to the weakness

News that the US was positioning nuclear subs in "appropriate regions" as a result of the inflammatory comments from former Russian Pres. Medvedev

The firing of the BLS chief in charge of the employment data for manipulating the data to make Trump look bad.

This unexpected news fueled fresh worries about the strength of the US economy.

Investors, who had been riding a wave of optimism, found themselves questioning what might come next.

2. Powell’s Hawkish Heartbeat

Jerome Powell, head of the Federal Reserve, did little to ease worries. He left interest rates where they are, but chose his words with care.

His cautious approach, even leaning “hawkish,” sent a clear message: rate cuts aren’t likely anytime soon.

Investors hoping for lower rates will have to wait. The Fed wants stronger evidence before making any changes, especially with rising tariffs pushing up prices.

This careful stance signals uncertainty for borrowers and businesses.

3. Trump Fires Top Labor Statistician

President Trump stunned Washington by firing Bureau of Labor Statistics Commissioner Erika McEntarfer.

His reason? He claimed, without evidence, that jobs numbers had been “manipulated” against him.

This rare move raised big questions about the independence of key US economic agencies.

4. Tariff Tsunami Incoming

Starting August 7, new US tariffs hit dozens of countries. Switzerland faces a 39% tariff, Canada 35% (on non-USMCA goods), and plenty of others see increases from 10% all the way to 41%.

African countries including Nigeria, Ghana, and South Africa also face new rates of 15–30%. These changes will ripple through global supply chains and could impact African businesses trading with the US.

5. Tech Titans: Earnings Extravaganza!

The week’s brightest spots were blue-chip US tech giants:

Meta (formerly Facebook) absolutely smashed Q2 numbers—revenue up 22% year-over-year, profits cruising as their AI investments drive more ad income, stronger margins, and user engagement. Mark Zuckerberg’s calling it the dawn of “personal superintelligence”—and Wall Street is loving it.

Apple posted a record $95.4 billion in revenue, topping estimates thanks to red-hot iPhone demand and a China sales comeback—even as new tariffs threaten future costs.

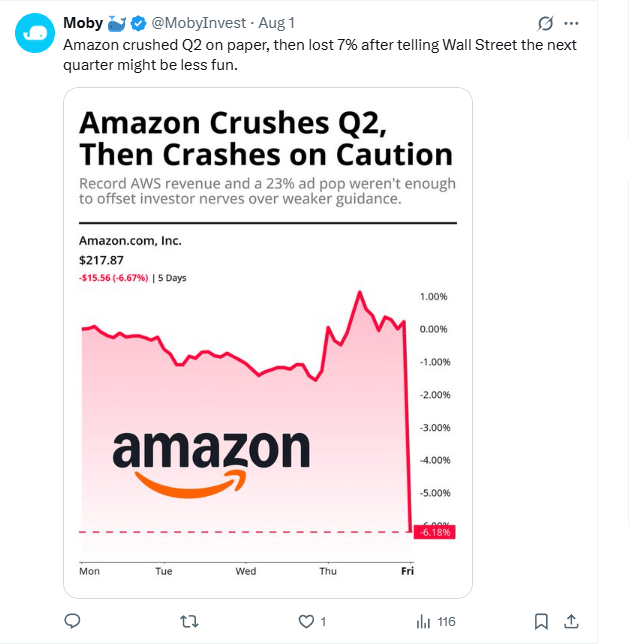

Amazon delivered $167.7 billion in sales, beating forecasts, but its cloud (AWS) growth spooked investors. The company says tariffs haven’t hurt much yet—but the rest of the year is anyone’s guess.

Microsoft: Cloud and AI businesses soared, with a 15% jump in quarterly revenue. They’re betting big on AI and proving it pays.

What Could Happen Next? Risk Watch & Forward Scenarios

More Volatility. Political drama in Washington may shake global faith in US economic data. Short-term swings could continue.

Focus on AI and Tech. Tech giants like Meta, Microsoft, and Apple have posted impressive earnings, showing that the market values companies deeply invested in technology and artificial intelligence.

These leading companies set the pace for others, showing that betting on tech and AI is not just a trend, but a clear path to value and growth.

The push toward smarter automation and better tools is expected to power the next wave of economic growth, creating new opportunities and raising the bar for tech advancement worldwide.

Tariff Trouble. If trade partners hit back with their own tariffs, more sectors could struggle. This would hurt supply chains and earnings. Watch for further US-China, US-EU tensions.

Fed Moves Still Key Federal Reserve actions keep grabbing the spotlight. If job growth slows but prices still climb, the hope for lower interest rates will stick around.

Businesses might hold off on big decisions, and families may put off big buys, waiting for some relief.

The central bank’s path matters for everyone’s wallet, shaping how we spend, save and plan for the future.

Your Move: Time to Buy?

If you have extra cash or margin available, this is a strong chance to take action. Once the current chaos settles, and it may take some time, we see this as a good spot to buy before prices bounce back into positive territory.

Stay Informed and Take Action!

Want to learn exactly how to start investing in US and global stocks from Africa?

Need step-by-step tips, analysis, and tools tailored for you?

Subscribe to The Global Hustlr!

We’re on a mission to empower African professionals with the knowledge, guidance, and access needed to confidently build global wealth—no matter your starting point.

You’ll get:

Weekly actionable breakdowns of global trends (like this one!)

How-tos, guides, and portfolio tips just for African hustlers

Community support and access to trusted resources & platforms

Ready to up your wealth game?

Hit “subscribe”—and join the movement!

Until next time: keep hustling, keep learning, and let’s unlock global opportunity—together.

The Global Hustlr—Your passport to wealth, from anywhere in Africa!

This newsletter is strictly educational and not investment advice. The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser.

Reply