- THE GLOBAL HUSTLR

- Posts

- Experts Blueprint: How to Turn This Week’s Market Carnage Into Life-Changing Gains

Experts Blueprint: How to Turn This Week’s Market Carnage Into Life-Changing Gains

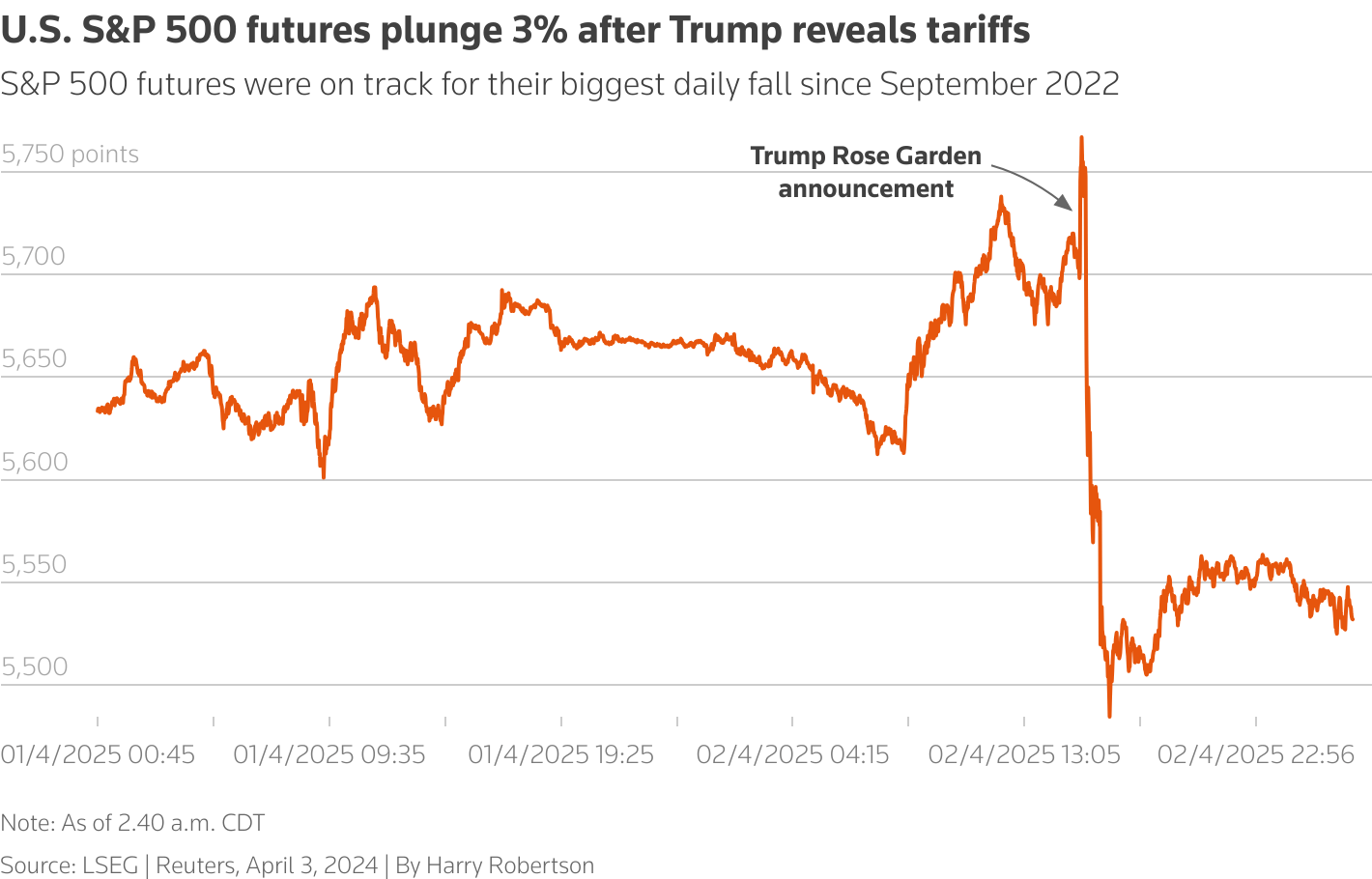

This week’s historic selloff—triggered by Trump’s 10% baseline tariff —erased $5 trillion from the S&P 500, marking one of the steepest two-day declines in modern history.

The Nasdaq looked set to confirm a bear market on Friday, down more than 20% from its record high.

Companies like Apple, Microsoft, Alphabet, Amazon, and Nvidia — already navigating regulatory scrutiny and supply chain recalibrations — now face an additional layer of complexity because China is not only a vital consumer market but also a critical node in production

While panic dominates headlines, top investors see opportunity in the chaos.

To help you navigate this turbulent time, we’ll look at insights from three market leaders: Tom Lee, Cathie Wood, and Warren Buffett.

They each have their ways of exploiting market volatility and turn downturns into opportunities.

Historical Context of Tariffs in Financial Markets

To understand how today’s tariffs may affect your portfolio, it’s helpful to look back at past tariff-related market reactions.

Historical data shows that previous tariff announcements have often led to short-term fluctuations but not always long-term declines.

For instance, during the trade tensions initiated in 2018, the markets experienced sharp selloffs, but many sectors rebounded as companies adapted to the shifting landscape.

Historically, markets tend to stabilize following these announcements once investors reassess the real impacts on companies and the economy. Awareness of this cycle can help investors keep calm during the chaos.

Expert Insights: Strategies for Capitalizing on the Dip

Experts like Tom Lee, Cathie Wood, and Warren Buffett have valuable perspectives on how to turn this market situation to your advantage. Let’s explore their strategies

Tom Lee's Perspective: Taking Advantage of Market Sentiment

Tom Lee, co-founder of Fundstrat, believes this dip could be a golden opportunity. His research indicates that market sentiment often overreacts to news, leading to temporary drops. During these moments, Lee advises investors to buy marginally undervalued stocks, especially those with strong fundamentals.

He encourages investors to maintain a long-term view, as historically, those who buy during downturns often see significant gains when the market stabilizes. Lee’s philosophy is rooted in the belief that emotional reactions often lead to irrational selling. Taking advantage of these dips might just pay off in the long run.

Cathie Wood's Approach: Long-Term Growth and Innovation Investments

Cathie Wood, the founder of ARK Invest, has a different take. Her focus is on innovative sectors such as technology and biotechnology. Wood suggests that downturns can present excellent opportunities to invest in high-growth companies that are fundamentally sound.

Her strategy centers around identifying companies that can thrive despite economic headwinds. For instance, she believes stocks in electric vehicles, gene editing, and cloud computing are prime areas for investment. By concentrating on innovation, Wood positions her investors to capitalize on emerging trends poised for growth.

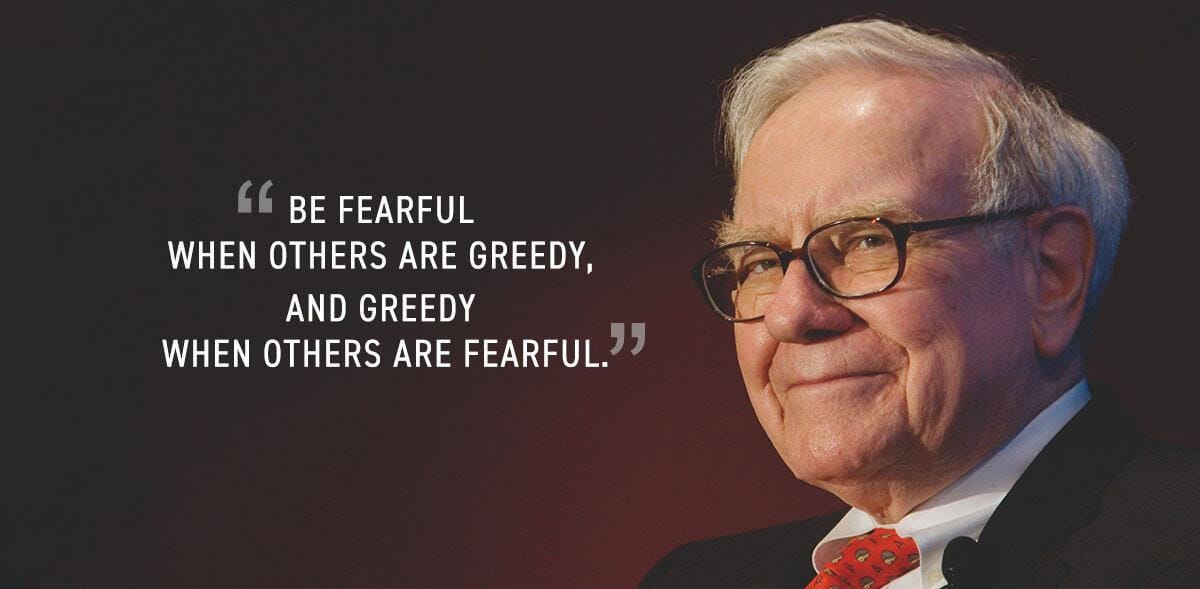

Warren Buffett's Timeless Strategies: Value Investing in Crisis

Warren Buffett, often considered the oracle of Omaha, champions a value investing approach that shines in times of crisis.

. While Buffett hasn’t commented publicly on the tariffs. Buffett promotes buying solid companies at discounted prices during market declines:His mantra: "Be fearful when others are greedy and greedy when others are fearful."

Patience over panic: With $321B in cash, Berkshire awaits steeper discounts before deploying capital.

Quality over quick rebounds: Buffett-style investors should prioritize durable businesses trading below intrinsic value, not oversold meme stocks.

“When it’s raining gold, reach for a bucket”: Significant buying may only occur if markets fall further, making current dips a rehearsal for bigger opportunities..

Practical Steps for Investors

Now that we’ve explored expert insights, what can you do to benefit from the current market conditions?

Embracing Opportunities Amid Uncertainty

The recent market turbulence can be intimidating, but it also presents unique opportunities. Tom Lee, Cathie Wood, and Warren Buffett each offer valuable strategies for navigating these uncertain waters. By being informed and proactive, you can turn this week’s market carnage into life-changing gains.

Investing is not just about timing the market; it’s about understanding the underlying fundamentals and making informed decisions. Keep a cool head, assess your risk, diversify your investments, and you might just find that this dip is the opportunity you’ve been waiting for.

The Global Hustlr Advantage

As your trusted partner in global investing, we're here to help you navigate the complexities of international markets.

Our mission is to empower you with the knowledge, strategies, and connections to build a thriving global portfolio

�� Ready to take your investment game to the next level?

Subscribe to The Global Hustlr

We help you:

Learn everything you need to know to invest successfully

Build a global portfolio and stay ahead in international markets like the USA, UK, and Europe.

Stay informed about game-changing shifts in technology, economies, and industries worldwide.

Navigate the challenges of international investing and protect your wealth from market volatility

Happy investing,

The Global Hustlr Team

Reply