- THE GLOBAL HUSTLR

- Posts

- AI Comeback & Rate-Cut Hopes

AI Comeback & Rate-Cut Hopes

👋 Hey Hustlrs,

This is The Global Hustlr, the newsletter where we break down Wall Street’s major weekly events into bite-sized, actionable lessons for ambitious African professionals—because your wealth doesn’t need a local postcode!

In this edition, you’ll get a simple, fun, and actionable breakdown of what moved markets, why it matters for African investors, and how to position calmly for the next leg of this cycle.

Let’s jump into the markets

☕️ Quick Brew: This Week’s Market Pulse

📈 Big Thanksgiving rally

🤖 AI back on top

🏦 Rate-cut hopes firm up

🧾 Data fog continues

🌍 Cross-asset “everything rally”

🪙 Gold steady, crypto stabilizes

🔑 The Big Stories

1. Thanksgiving Rally

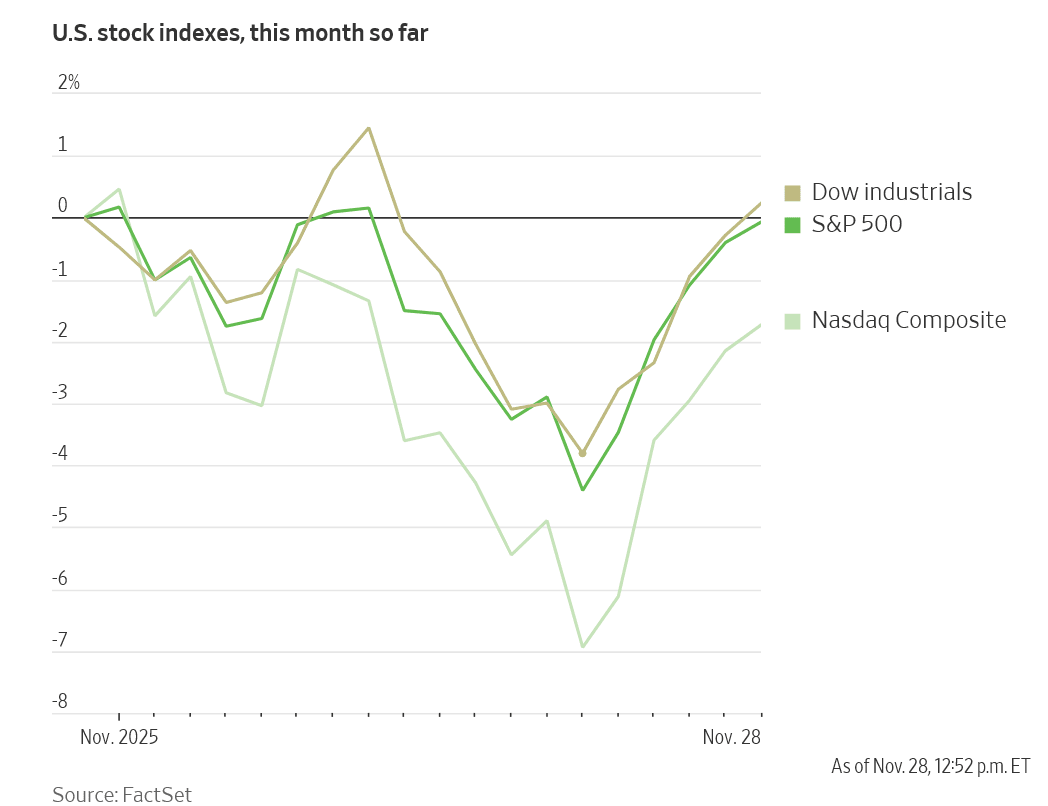

US stocks delivered a powerful five-day winning streak, with all three major indices logging their best weekly performance since mid-year.

The S&P 500 jumped about 3.7%, the Dow Jones Industrial Average gained roughly 3.2%, and the Nasdaq Composite surged around 4.9% in one of the best weeks of the year.

Broad participation mattered: 10 of 11 S&P sectors finished Friday in the green, showing buyers are not just hiding in a handful of mega-caps.

📌 Why it matters: For long-term investors, this is a classic reminder that pullbacks can be temporary, and staying invested in quality US equities beats trying to time every dip—especially when the macro backdrop is slowly turning more supportive.

2. AI Back In the Driver’s Seat

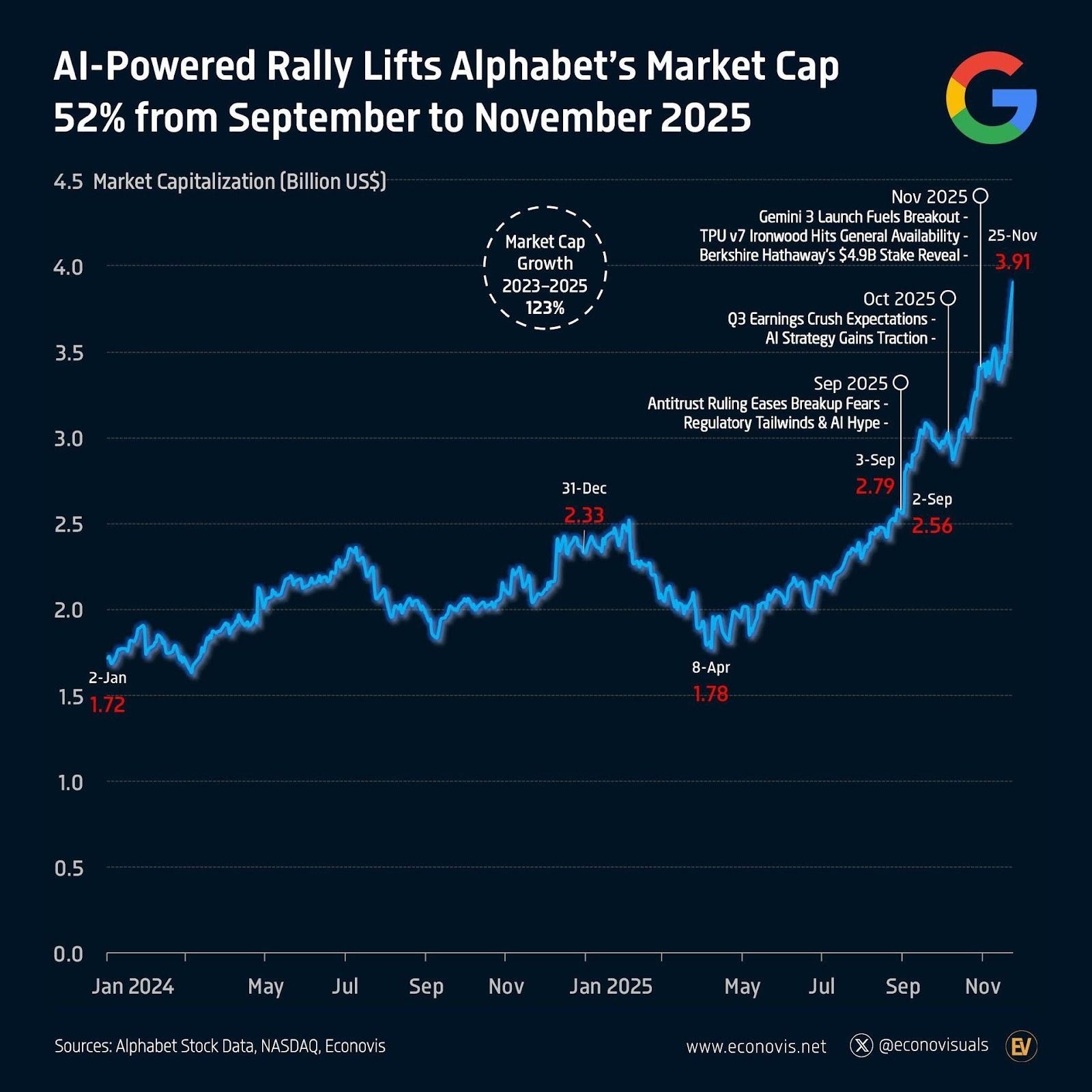

The AI trade re-accelerated, with Alphabet rallying strongly on optimism around its latest Gemini AI model and its growing role in cloud and AI infrastructure.

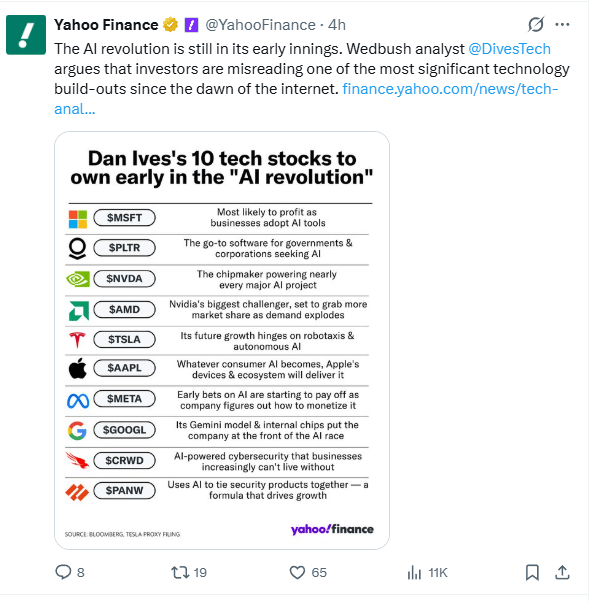

Other AI winners, including major chip and cloud names, stabilized after earlier profit-taking, helping the Nasdaq notch its best week since May even though November as a whole still broke its winning streak.

Investors are now talking less about an AI “bubble popping” and more about a rotation within AI—from the most crowded names into those seen as under-owned beneficiaries.

📌 Why it matters: AI remains a long-term structural theme, but leadership within the theme is shifting, so African investors are better served by diversified AI exposure (broad tech ETFs or baskets of quality names) instead of betting everything on one “AI hero” stock.

3. Fed Cut Hopes vs. “Data Fog”

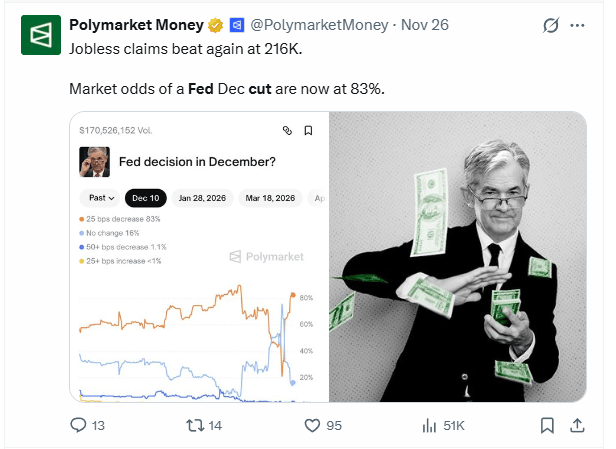

Thanks to the earlier US government shutdown, key October CPI data was canceled and some labor-market releases have been delayed, leaving the Fed with fewer fresh hard numbers going into its December meeting.

Even so, rate-futures markets now price a high probability of a December rate cut, as investors focus on previous disinflation trends and signs of softer consumer momentum.

With less data, every speech from Fed officials now carries more weight, swinging expectations and yields in short, sharp bursts.

📌 Why it matters: Lower rates are good for growth and tech over the long run, but the path there will be choppy; expect sudden moves around Fed headlines and avoid over-leveraging or trading emotionally around news days.

4. “Everything Rally” Across Assets

This week wasn’t just about stocks: bonds, some commodities, and even Bitcoin participated in an “everything rally,” as fears eased and liquidity flowed back into risk assets.

Equities, bonds, Bitcoin , and even some commodities moved higher together, signalling a broad improvement in risk appetite.

Gold stayed resilient near recent highs, supported by still-elevated geopolitical risk and the prospect of easier monetary policy, while Bitcoin bounced off its recent lows as sentiment in crypto shifted from extreme fear to cautious optimism.

📌 Why it matters: When many assets rally at once, it often reflects improving liquidity and risk appetite—but also a setup where disappointment can hurt multiple parts of a portfolio at the same time, making diversification and position sizing even more important.

💡 What Does This Mean for Your Investments?

Rate-cut optimism lifts growth: Expectations of a December Fed cut are fueling demand for US growth and tech, especially AI, but valuations in some names are already rich, so think “phased buying” rather than all-in at once.

AI is a long game, not a lottery ticket: The rebound in Alphabet and other AI leaders shows the theme is alive, but leadership within AI will rotate; diversified tech exposure (broad US tech or innovation funds) can reduce single-stock risk.

Macro data gaps mean more noise: With inflation and jobs data partially missing, markets will over-react to speeches and headlines; avoid chasing 1-day moves and keep your focus on 3–5-year outcomes, not 3–5-hour volatility.

Gold and Bitcoin play different roles: Gold is behaving like a steady hedge against policy and geopolitical risk, while Bitcoin is trading like a high-beta risk asset; they are not interchangeable in a portfolio.

Action steps you can apply now:

Consider dollar-cost averaging into quality US equity or tech exposure instead of trying to pick the perfect entry after a strong week.

Review your risk buckets: keep AI and crypto as growth/satellite positions, and make sure your core is anchored in diversified US and global equity exposure plus some defensive ballast (cash, gold, or lower-volatility funds).

📣 Final Sip

Weeks like this are a great reminder that markets often reward patience just when fear was peaking a few days earlier.

Your edge as a Hustlr is not guessing the next headline—it’s staying calm, informed, and relentlessly focused on building wealth over years, not weeks.

🚀 Join the Movement

If this helped you make sense of a noisy week, share The Global Hustlr with another African professional who wants to grow wealth globally, not just locally.

Our mission is simple: give you the clarity, confidence, and tools to become a world-class investor from Lagos, Accra, Nairobi, Joburg—or wherever you Hustle.

Subscribe today and take control of your investment journey across borders.

Stay smart, stay global, stay Hustling.

The Global Hustlr Team!

This newsletter is strictly educational and not investment advice . The content provided does not constitute personal advice or a personal recommendation. No content should be relied upon as constituting personal advice or a personal recommendation when making your decisions. If you require any personal advice or recommendations, please speak to an independent qualified financial adviser.

Reply