- THE GLOBAL HUSTLR

- Posts

- 2025 Was Wild: How Tariffs, AI, Crypto & Gold Shaped Your Money This Year

2025 Was Wild: How Tariffs, AI, Crypto & Gold Shaped Your Money This Year

Hey Hustlr family 👋🏾

Hope you’re sipping something warm and feeling proud of how far you’ve come this year.

2025 has been wild for markets – stocks, crypto, gold, tariffs, wars – and you’ve still been showing up to learn and build. That already puts you ahead of the crowd.

This issue is your simple, no-stress recap of the big events that shaped 2025 – what moved markets, why it matters for you as an African professional, and what to watch as you keep growing your money.

☕️ Quick Brew: 2025 Major Events

Here’s the year in one quick sip:

📈 US stocks crashed in April… then came back to hit new highs by year-end.

🤖 AI and chip giants like NVIDIA became the new “oil”, powering a huge part of stock market gains.

🪙 Bitcoin and crypto had a rollercoaster year but finished higher, rewarding patient holders.

🥇 Gold and silver hit record levels as investors hunted for safety in a crazy world.

🌍 Tariffs, the Israeli-Iranian conflict, and a historic US government shutdown kept everyone on edge – but didn’t stop long-term wealth builders.

Now let’s break down the biggest themes like you’re chatting with a friend after work.

🔨 Tariff Shock & The April Crash

In early 2025, Donald Trump rolled out his “Liberation Day” tariffs – big new taxes on imports from many countries. That move hit global trade fears hard and sent the US stock market into a sharp, sudden fall in March and especially April. The S&P 500 – the main US stock index – briefly dropped into bear-market territory, and high-risk assets like crypto also took a big hit.

For you as an investor, this was a live lesson in how politics and policy can shake markets overnight. But it was also a reminder that markets often overreact first and think later.

Once the US started softening some of the tariff plans and offering exemptions, stocks began to recover, and by mid-year the market had clawed back its losses.

If you panicked and sold at the bottom, you locked in pain. If you stayed calm, you saw how quickly things can turn.

Action for you:

Build a strategy that doesn’t depend on “perfect politics” – use diversification (stocks, ETFs, maybe a small slice of crypto, and some defensives) so one policy shock doesn’t blow up your whole plan.

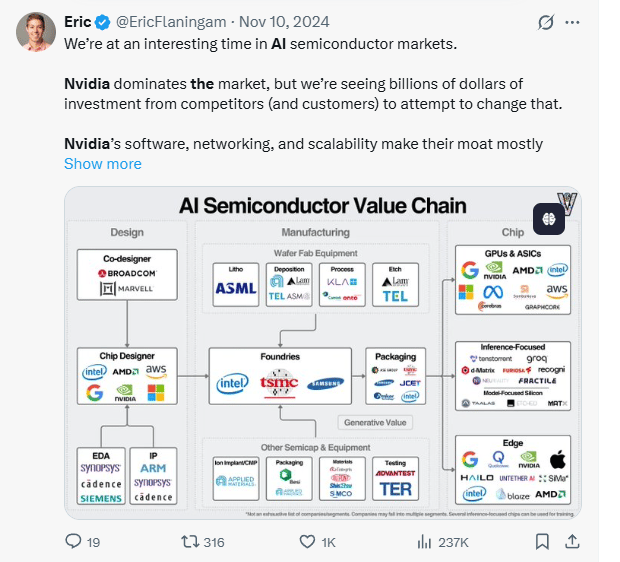

🤖 AI Mania & The NVIDIA Effect

If 2023–2024 were the warm-up, 2025 was the full-blown AI season.

Chipmakers and AI infrastructure players like NVIDIA became the stars of the show.

Every major index move seemed tied to AI: when AI names ran, the market ran; when they wobbled, everything felt shaky.

This mattered for two big reasons.

First, a small group of mega-cap tech companies drove a huge share of stock market gains, especially in the US.

Second, AI stopped being “future talk” and became real spending by companies – from data centers to cloud to AI tools.

For investors like you, the message is simple: AI is no longer a side theme; it’s a core driver of global markets.

Action for you:

You don’t need to pick the next NVIDIA. Instead, look at broad ETFs or diversified funds that give you exposure to AI, chips, and big tech – so you ride the wave without betting on a single hero.

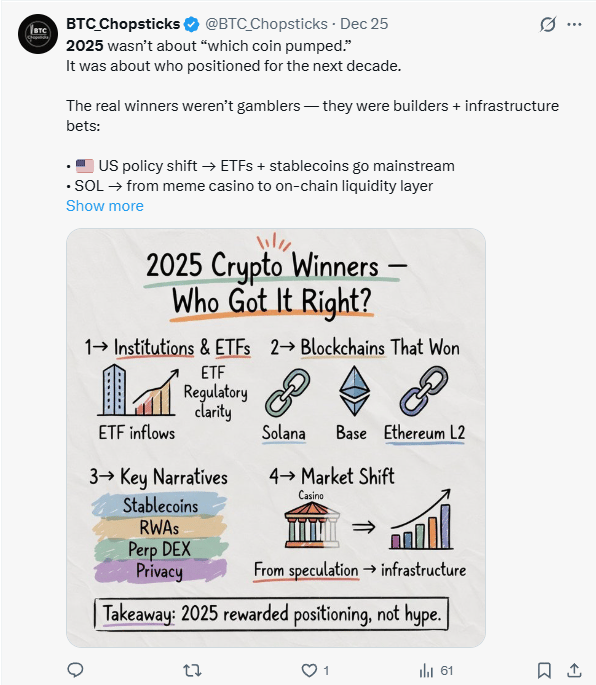

🪙 Crypto’s Rollercoaster & The Rise of “Digital + Hard Money”

Crypto in 2025 felt like a telenovela – drama, dips, and comebacks.

After a strong start to the year, Bitcoin and altcoins were hit by tariff chaos and a risk-off mood in April, dropping alongside stocks. But as the year went on – especially after the US Federal Reserve moved from just “watching” to actually cutting rates – the tide turned.

At the same time, old-school money – gold and silver – had its own moment.

With wars, trade fights, and even a record US government shutdown, investors rushed into safe assets, pushing gold and silver prices to or near record highs.

That created an interesting picture: digital assets (like Bitcoin) and hard assets (like gold) both playing a role as “insurance” in an unstable world.

Action for you:

If you choose to add crypto, treat it like chilli pepper – a small amount on the side, not the whole meal. And remember: a bit of “protection” (gold, cash buffer, defensive assets) can help you stay invested when markets get scary.

🌍 Geopolitics, War & A Historic US Shutdown

Beyond charts and tickers, 2025 reminded everyone that real-world conflict hits portfolios.

The Israeli-Iranian conflict and wider Middle East tensions kept oil, gold, and global risk sentiment on edge through the year.

Markets hate not knowing what comes next, so every flare-up brought fresh volatility.

On top of that, the US went through the longest government shutdown in its history, stretching for weeks before finally ending in November.

That meant delayed data, uncertainty about growth, and a lot of nervous headlines. Yet, once the shutdown ended and the economic numbers came out, they showed the US economy had actually grown strongly before the shutdown, and the S&P 500 closed near record highs by December.

Action for you:

Don’t let headlines push you into emotional decisions. Geopolitics will always be messy. Your edge is having a plan you can follow even when the news is loud.

📈 The Big Picture: Stocks Up, Despite the Drama

Here’s the twist: after tariffs, crashes, wars, and shutdowns… US stocks still ended 2025 up strongly, with the S&P 500 closing near record highs by late December.

The US economy grew at a healthy pace, helped by strong consumer spending and exports, even with all the noise.

If you zoom out, 2025 looked like a classic investor test: can you stay calm when it feels like the world is on fire?

The people who stayed invested in broad, quality assets – instead of trying to time every swing – were rewarded.

Action for you:

Think like a long-distance runner, not a sprinter. Set up automatic investing (monthly or quarterly), choose solid global exposure, and let time do the heavy lifting.

Best Performing Stocks and ETFS IN 2025

🏆 2025 Winners: Who Led The Market (And How You Can Ride Along)

2025 produced some clear winners – not just meme stocks or tiny penny names, but big, real businesses and ETFs that benefited from powerful themes like AI and safe-haven demand for gold and silver. As an African professional, the key lesson is simple: you don’t need to guess the single best stock – you just need to be positioned where the winners live.

🚀 Stock Winners: AI, Chips & Gold

You didn’t have to look far to see a pattern in the stock winners.

Many of the strongest performers in 2025 were tied to AI infrastructure and precious metals.

Memory and storage companies like Western Digital, Seagate, and Micron soared as data centres and AI models demanded more and more high-end chips and storage.

A major gold miner like Newmont rallied as gold prices pushed toward record highs thanks to tariffs, wars, and the US shutdown.

Retail-trading-focused platforms gained as more people jumped back into markets and crypto, pushing trading activity higher.

If you zoom out, the story is clear:

AI + data + “safety” (gold) = 2025’s power combo.

Top 5 large-cap stocks in 2025 (YTD)

These are among the best performers in the S&P 500 in 2025, based on year-to-date returns.

Rank | Stock | Sector / Theme | 2025 YTD Return | Why it did so well |

|---|---|---|---|---|

1 | Western Digital (WDC) | Memory & AI infrastructure | 261% | Rode the AI boom as demand for high-capacity storage exploded in data centers and cloud, plus improving pricing in the memory market. |

2 | Robinhood Markets (HOOD) | Retail trading / fintech | 233% | Benefited from renewed trading activity in stocks and crypto, better profitability, and optimism about new product lines. |

3 | Seagate Technology (STX) | Storage & AI-driven hardware | 217% | Another key storage player leveraged data-growth and AI server demand, with margins improving as the cycle turned up. |

4 | Micron Technology (MU) | DRAM / NAND for AI & cloud | 178% | Strong pricing power and surging demand for high-bandwidth memory used in AI chips drove earnings upgrades and multiple expansion. |

5 | Newmont (NEM) | Gold miner | 138% | Rallied with record or near-record gold prices as investors rushed into safe-haven assets during tariff shocks, war risks, and the US shutdown. |

📦 ETF Winners: Silver, Gold & Tech Packs

On the ETF side, some of the best performers were precious-metal trackers and tech-heavy funds.

Silver and gold ETFs did extremely well as investors rushed into hard assets for protection.

Tech and semiconductor-focused ETFs benefited from the AI boom, riding the strength of chipmakers and big-tech platforms instead of one single stock.

Some leveraged ETFs on semiconductors and the Nasdaq amplified these moves for short-term traders (though they’re very risky and not ideal for beginners).

Again, the pattern repeats: themes mattered more than individual stock stories. If you were in the right “basket”, you participated in the upside.

Top 5 ETFs in 2025 (YTD)

From broad ETF rankings and thematic lists, these are among the standout performers globally in 2025

Rank | ETF | Focus | 2025 YTD Return | Key driver in 2025 |

|---|---|---|---|---|

1 | Silver ETF (e.g., iShares Silver Trust – SLV) | Physical silver | 150–165% (best silver index range) | Silver surged on haven demand, green-energy use, and tight supply, making silver-tracking ETFs some of the best performers globally. |

2 | SPDR Gold Shares (GLD) | Physical gold | 60% | Gold hit record levels as investors hedged against tariffs, war risks, and policy uncertainty, boosting major gold ETFs. |

3 | Vanguard Information Technology ETF (VGT) | US large-cap tech | 21% | Packed with AI and big-tech winners, it rode the same AI wave that lifted NVIDIA, chipmakers, and cloud platforms. |

4 | Direxion Daily Semiconductor Bull 3x (SOXL) | Leveraged semiconductors | 52% | Magnified the huge move in chip stocks driven by AI demand, though with very high volatility and trading-only risk. |

5 | ProShares UltraPro QQQ (TQQQ) | Leveraged Nasdaq 100 | 39% | Leveraged exposure to mega-cap tech and AI leaders produced strong YTD gains as the Nasdaq marched toward record highs. |

🌍 What This Means For You (As An African Investor)

Here’s the good news: you don’t have to be in New York or London, or spend all day reading charts, to benefit from these winners. You just need a simple way to plug into:

Global AI and tech

Gold and silver as protection

Broad US market exposure

That’s where broad ETFs come in. Think of them like a ready-made “combo plate” of stocks. Instead of guessing which single chip company or miner will win, you buy a fund that holds many of them. If the theme wins, you’re likely to benefit.

Depending on your broker and access, you can look for:

A global or US equity ETF that tracks a big index (like the S&P 500 or a world index).

A tech or innovation ETF that tilts toward AI and digital infrastructure.

A gold or precious-metal ETF for a small slice of long-term protection.

You don’t need to chase the exact top 5 names of the year. You just need exposure to the right neighbourhoods.

🧭 Simple Takeaway: Own Themes, Not Headlines

If there’s one lesson from the 2025 winners, it’s this:

Don’t try to be the genius who finds the next Western Digital or Micron early. Be the steady builder who owns the AI, tech, and hard-asset themes through simple, broad ETFs.

As an African professional, your edge is consistency, not prediction. Set up:

A regular investment into a broad global/US ETF

A smaller tilt into AI/tech

A modest allocation to gold/precious metals if it fits your risk profile

Then let time, innovation, and compounding do the heavy lifting.

📣 Final Sip

If 2025 taught you anything, let it be this: markets are noisy, but wealth building is quiet.

You don’t need to predict tariffs, wars, or rate cuts to win. You need patience, a simple system, and the courage to keep going when things feel uncertain.

Every month you stay informed, invest a little more, and avoid emotional decisions, you’re moving closer to financial freedom – not just for you, but for your family and future generations.

🚀 Join the Movement

If this breakdown helped you make sense of a crazy year, don’t keep it to yourself.

Share this newsletter with one friend or colleague who wants to start investing globally.

Hit subscribe so you never miss the next simple, practical breakdown of what’s happening in markets and how it affects you as an African professional.

Stay plugged into The Global Hustlr community – where the mission is clear: help Africans everywhere learn the game, access global markets, and build serious wealth, step by step.

You’re not late. You’re right on time. Let’s keep learning, investing, and hustling – globally. 🌍💼📈

Reply